Specification

veYFI incorporates YIP-56: Buyback and Build funds into YFI tokenomics. Users can lock YFI tokens and receive veYFI, which allows them to boost vault rewards and vote on where bought-back YFI will be sent.

veYFI Overview

- Locking is similar to the ve-style program of Curve.

- YFI can be locked into veYFI, which is non-transferable.

- Lock duration can be decided on deposit: from 1 week to 4 years.

- You can actually lock up to 10 years, but anything above 4 years doesn’t give you more veYFI. This way you don't have to relock every week. If you set it to longer than 4 years, you can always reset it to 4 years so it starts decaying.

- A user must have a veYFI lock earn boosted rewards. No lock leads to no boosted rewards. A Maximum lock, continuously renewed, maximizes rewards.

- Just like with Curve, even without a veYFI lock, you can still deposit into a vault and stake the vault token into a gauge which will give you the base boost. With the minimum boost, you get to keep 10% of the dYFI you farm. The other 90% goes to veYFI lockers.

- It’s possible to exit the lock early, in exchange for paying a penalty that gets allocated to the other veYFI holders.

- The penalty is up to 75% locked amount and decays over time:

- The total penalty is the minimum percentage between

75% locked amountand(time remaining / 4 years) - So if your lock is over 3 years you will pay 75%.

- If your lock is 2 years you will pay 2/4 = 50%

- Penalty Formula:

min(75%, lock_duration_left / 4 years * 100%)

- The total penalty is the minimum percentage between

- veYFI holders are eligible to receive a share of the early exit penalties.

- veYFI holders are eligible to receive a share of gauge dYFI rewards from unused boosts.

- Now that veYFI has been implemented, only veYFI is accepted voting power in Yearn Governance.

dYFI as Gauges Reward

-

dYFI is an ERC-20 token.

-

Gauges emit dYFI that users can either sell for ETH or convert to YFI at a cost.

-

Gives its bearer the right to redeem an equivalent amount of YFI in exchange for ETH.

-

dYFI is burned upon redemption.

-

The circulating supply of dYFI must not exceed the amount of YFI available to be redeemed as part of the tokenomics program.

-

The amount of ETH required for redemption is at a discount to the current spot price of YFI/ETH.

-

ETH received from dYFI redemption is redirected to automated YFI buybacks handled by an immutable smart contract that runs Dutch auctions.

-

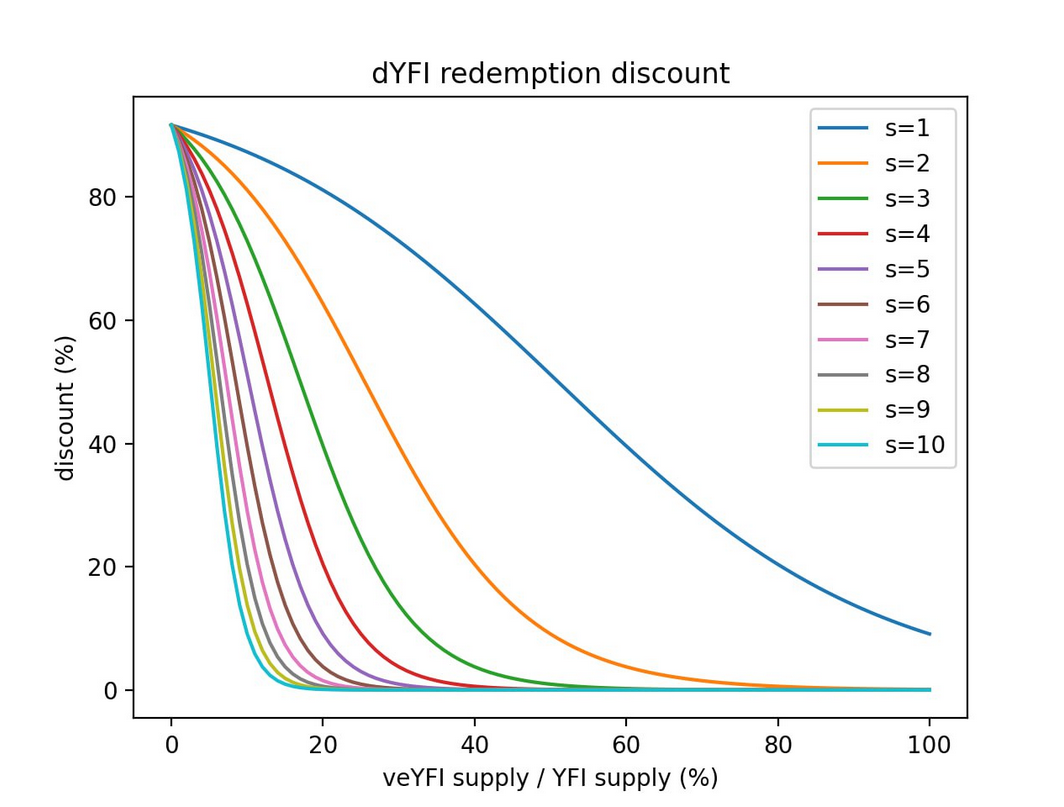

Discount calculation is a function of the veYFI and YFI supply with the following formula:

- discount =

c / (1 + a * e^k(s * x − 1)), where:- c =

1 - a =

10 - k =

4.7 - s =

configurable scaling factor(currently set to 10) - x =

veYFI_supply / YFI_supply

- c =

Current On-Chain Values

- The current redemption discount is:

Fetching contract data... - Current Spot Price of YFI/ETH:

Fetching contract data... - ETH required to redeem 1 dYFI:

Fetching contract data...

- discount =

Vault Gauges + Voting

- Vault gauges allow vault depositors to stake their vault tokens and earn dYFI rewards according to their veYFI weight.

- Weights decay as the remaining lock duration decreases and can be extended up to the max lock duration.

- Increased locking duration is rewarded with increased weight, so locking for 4 years gives 100% weight, locking for 2 years 50% weight, etc.

- dYFI is allocated to gauges based on bi-monthly governance votes. Each gauge can get a different amount dYFI to emit.

- Users can boost their gauge rewards by up to 10x.

- This boost amount is proportional to the user's share of the vault and their share of total veYFI.

- A 10x boost is achieved when a user owns an equal or higher share of veYFI (

yourVeYFIBalance/veYFITotalSupply) than they own of the gauge deposits (yourGaugeDeposit/totalDepositedInGauge). - The greater your share of total veYFI, the more vault deposits can be boosted for the user.

- This applies across multiple gauges. You can max boost 1% of all gauges with 1% of the veYFI supply.

- A claim with boost under 100% will send the leftover tokens to veYFI holders.

- The boost mechanism math works as follows:

# determine user share of veYFI

UserVeYFIShare = VeYFIBalance / VeYFITotalSupply

# Determine boostable balance above 10% of deposit

BoostableBalance = (AmountDepositedInGauge /10) + (TotalDepositedInTheGauge * UserVeYFIShare * 0.9)

# take the less of amount deposited in gauge and boostable balance

BoostedBalance = min(AmountDeposited, BoostableBalance)

# get the boost by multiplying by 10 and dividing by amount deposited in gauge.

Boost = 10 * BoostedBalance / AmountDepositedInGauge

veYFI Reward Pool

- Users who lock YFI for veYFI can claim accumulated fees from the veYFI reward pool. The reward pool gets fees two ways: YFI from the veYFI early exit fee and the non-distributed gauge rewards due to a lack of full boost.

Additional Info

- Contract Addresses

- Governance Forum Thread: https://gov.yearn.fi/t/yip-65-evolving-yfi-tokenomics