Frequently Asked Questions and Troubleshooting

I don't see my deposit, where is it?

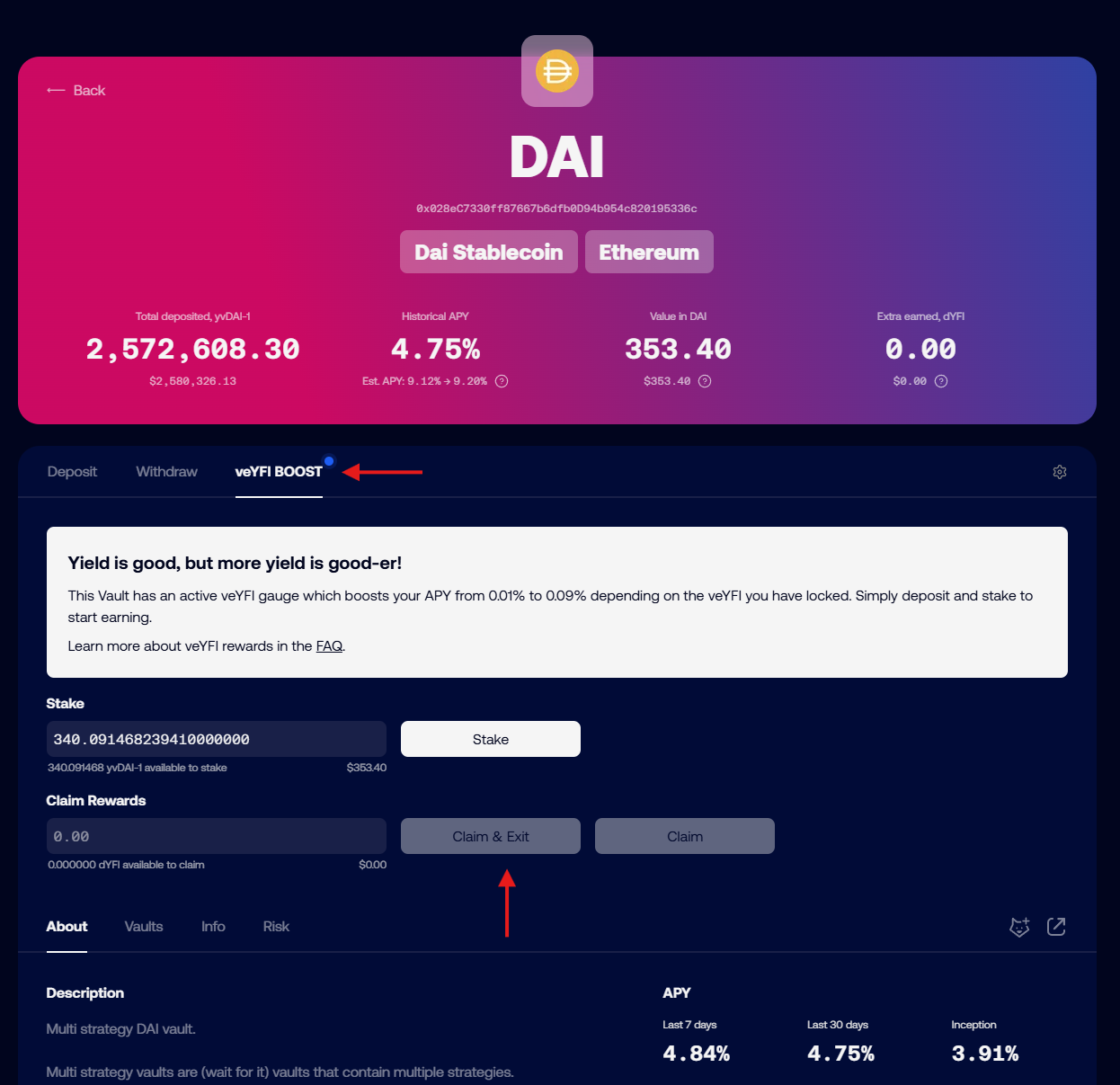

If you deposited into a Yearn Vault and then click the "withdraw" tab and don't see your tokens, don't worry, they are probably staked!

The default "deposit" action in yVaults with a gauge or other extra rewards is to deposit your tokens in the yVault and stake the yVault token for extra rewards. To see your yVault tokens, click on the "veYFI BOOST" tab (it may be named something else like "staking BOOST") next to the withdraw tab. You should be able to unstake your vault tokens there and then withdraw.

Update your default deposit settings

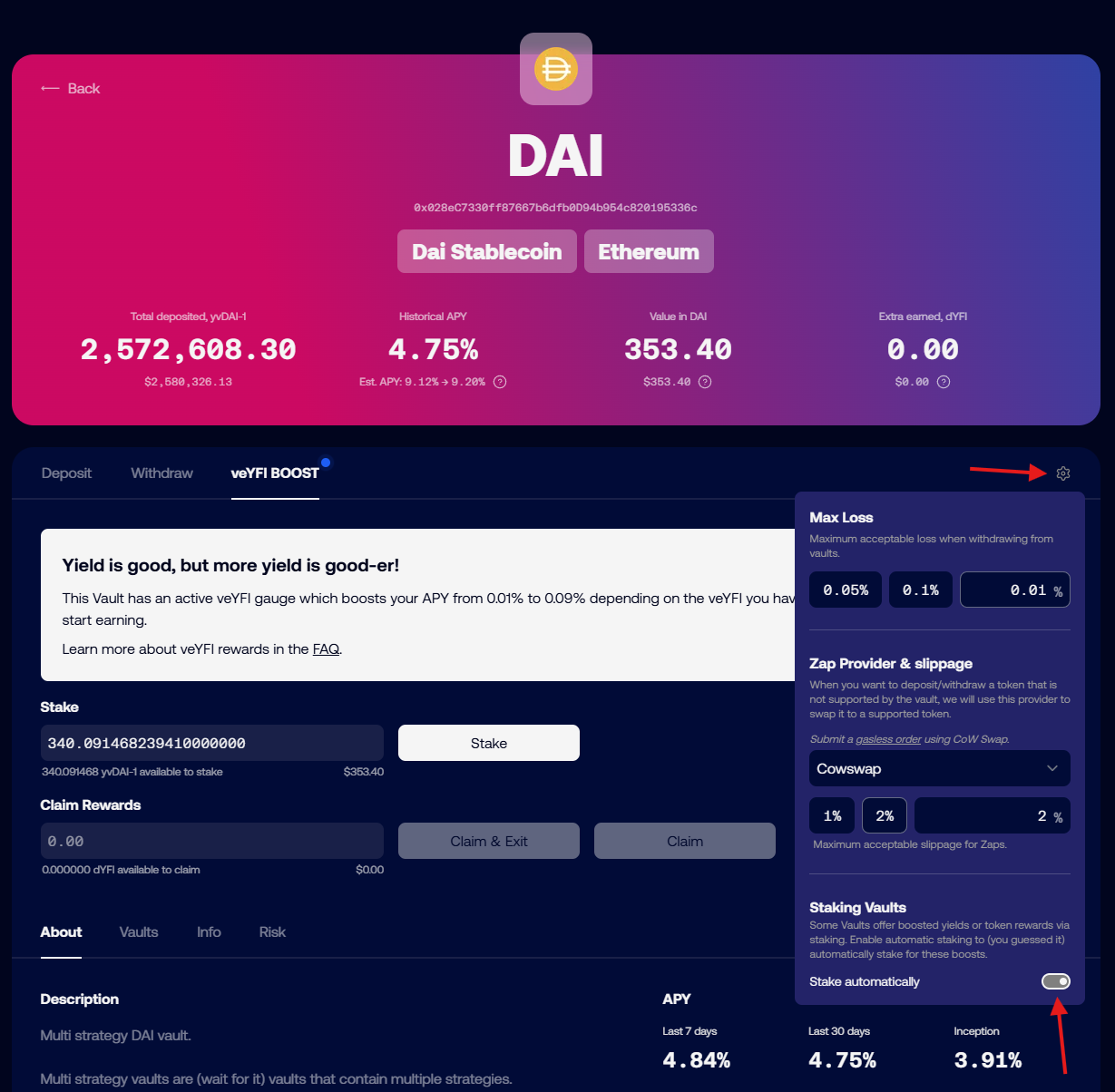

If you want to change the default deposit behavior to only deposit and not also stake the vault tokens, you can change that setting by clicking on the gear icon to the right of the tabs and unchecking "stake automatically" at the bottom of the menu that opens up.

My veYFI rewards are lower than expected, Why?

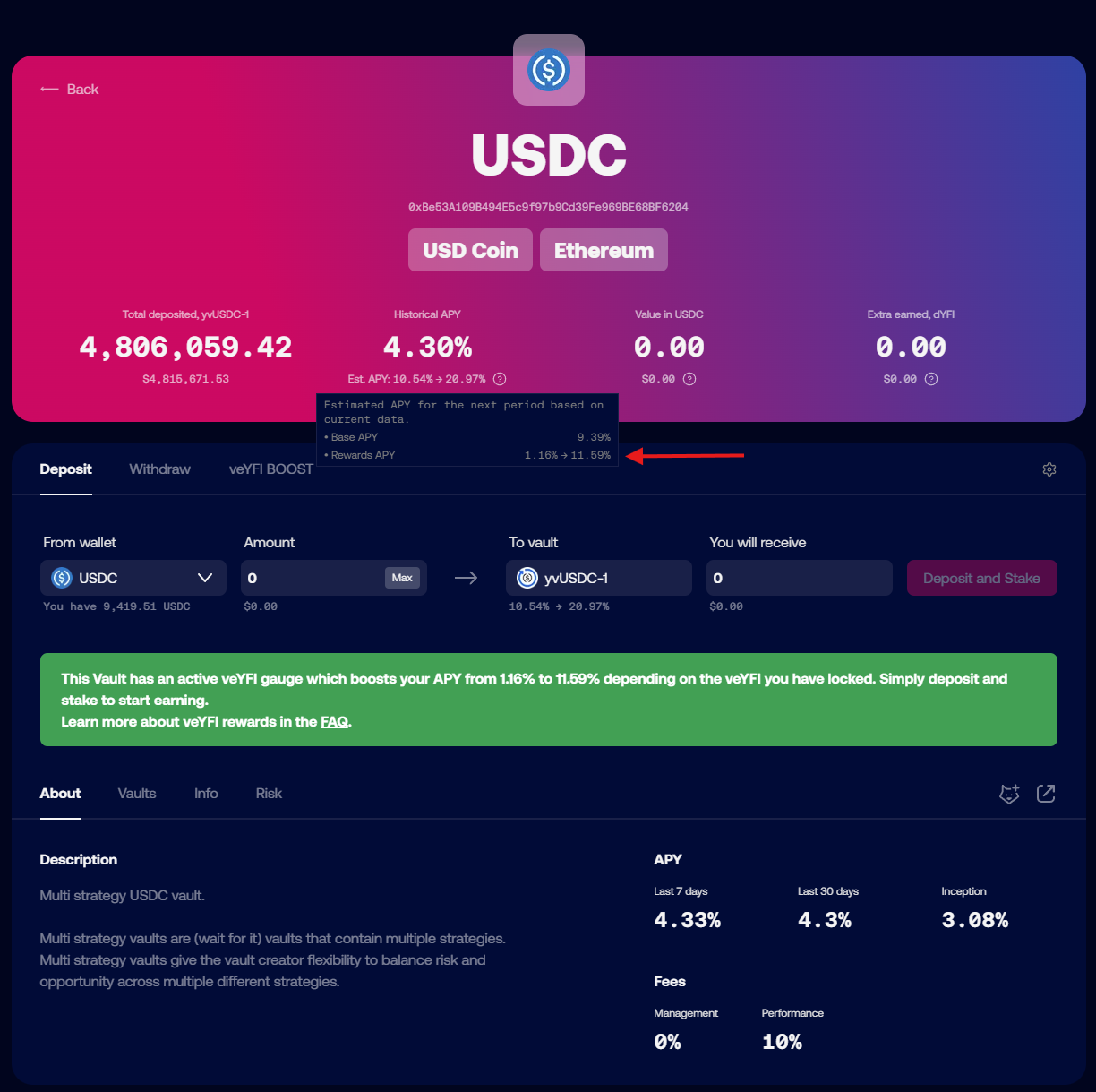

veYFI rewards are variable depending on how much veYFI your wallet holds. If you don't have veYFI, you will only get 10% of the maximum reward amount shown. In the image below, note the range of rewards APY. Without any veYFI, a deposit will earn a 1.16% boost, paid in dYFI.

If you don't have veYFI, you can deposit and stake your tokens using liquid lockers. By doing this you use the liquid locker's veYFI to boost your deposit.

Read more about veYFI, boosts, dYFI and liquid lockers on the veYFI page

And remember, you have to consider transaction costs when using Yearn. If using Ethereum mainnet, prices for transactions vary from a few dollars to tens or hundreds of dollars, depending on chain congestion (Yearn has no control over this). If you are depositing lower amounts (<$500-1000), you may want to consider using Yearn on an L2 so fees don't negate your interest earned.

A Website interaction isn't working. What do I do?

If an interaction on the website isn't working or your transaction doesn't go through on the Yearn UI (stuck with a spinning loading circle), there are a few things you can do:

- Perform a hard refresh on the web page:

ctrl+shift+Ron Windows,cmd+shift+Ron Mac. - Try using a different browser or wallet provider.

- If on mobile, try using the desktop version, and vice versa

- Change your wallet RPC for the network you are transacting on. This is the data endpoint that your wallet talks to to pull blockchain data.

- Here is a website with lists of different chain RPCs: https://chainlist.org/

- If you connect your wallet to the chainlist site, you can add new RPCs directly from there.

- If none of the above work, you can interact with Yearn smart contracts via a block explorer. See the next entry for more information on how to do that.

What are Liquid Lockers and how do they work?

Liquid Lockers are products built on top of Yearn's governance and incentive contracts. They have two main benefits, one for vault depositors and another for YFI holders.

For Vault Depositors

Yearn has an incentives system to encourage deposits in some of its most important pools. Yearn governance participants lock YFI (it becomes veYFI) and can vote on which pools get incentives and how much. These rewards are then given to depositors in the rewarded vaults, but the amount of rewards is heavily dependent on whether a user has locked YFI or not. You can read more about this here, but the gist of it is that if you down, hold veYFI you get 10% of the possible rewards.

Because locking YFI for veYFI is complicated, if you don't want to deal with the intricacies of locks, the Liquid Lockers let you use the locked tokens of other governance participants for a fee. As a depositor, you can earn 10x more rewards by doing this, and all you have to do is stake in the liquid locker contract. See below for links to the different liquid lockers. There are also autocompounding liquid locker vault contracts that you can deposit into. Find those on the main https://yearn.fi website.

For YFI Holders

If you want to participate in the liquid lockers system as a YFI holder, you can use their contracts that permissionlessly max-lock governance tokens (YFI to veYFI in this case) in exchange for a receipt token at a rate of 1:1. The benefit of doing this is to provide the end user with a fully transferrable token that can still receive a share of governance benefits like yield or voting power. But beware, Liquid locker tokens are not redeemable for the underlying locked tokens. Instead, they can be traded on decentralized exchanges. This means they may not always maintain price parity with their underlying assets.

Check out the current pegs of different liquid lockers here

The Lockers

At the time of writing, there are 3 liquid lockers for YFI:

Help me understand Deposits, Withdrawals, Zaps, and Swapping between Vaults

Deposits and Withdrawals

The standard way to enter and exit vaults is to deposit the underlying tokens directly into the contracts. That means if the vault is a single asset vault like the USDC-1 vault, you would deposit USDC. For a liquidity pool vault like a Curve factory vault, you would deposit the Liquidity pool token. For example, if you want to deposit into the Curve stETH Factory Vault, you would deposit the Curve LP token, which is the crvSTETH token that you get when depositing into that Curve pool.

Zaps

Some vaults allow zaps from and to other assets. If possible, these options will show up in the box to select what asset to deposit or withdraw. You should always check the output to make sure the zap is giving you a good rate. There is a max slippage feature on the zaps that you may need to adjust if it isn't working. Click on the gear at the top right of the deposit/withdrawal modal and you can set the slippage there.

![]()

Swaps

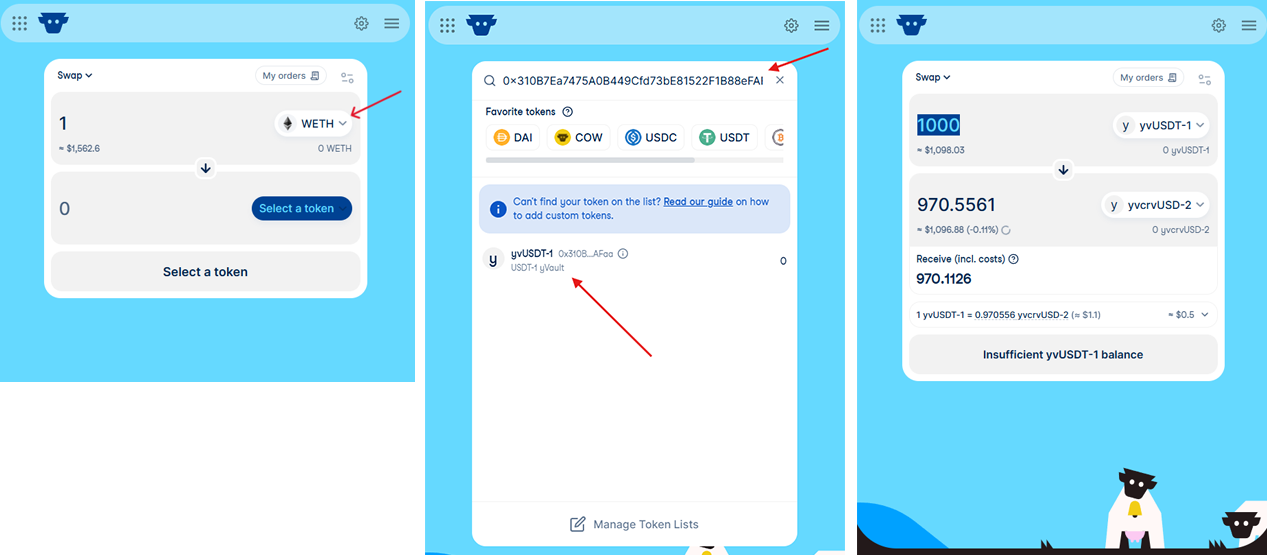

You can also swap directly between vaults or from vaults to assets using third-party services. Yearn works with a solver on Cowswap to provide routes between many different vaults and yearn assets. You may have to manually enter the vault or asset address in cowswap for it to be recognized. You can get that from the page for that vault, with the address living right below the name.

You can then paste that into the input or output fields of the cowswap interface. Always be sure to check and make sure the trade output looks right!

There are also other aggregators like Defillama and Kyberswap.

How do yPT (Pendle Tokens) work?

Yearn offers vaults for Pendle fixed term positions in a number of different assets. Pendle is a yield trading protocol that allows users to split their yield from their principal and sell either part. This allows end users to get fixed interest rates on their deposits by selling their yield, and other end users can speculate on yield rates. This is all quite complicated, requiring the user to know when terms end and begin and how to optimize everything. yPT vaults are built to make it simple. You can deposit into the vault and it will automatically roll over your deposits into the next term.

Some things to be aware of:

- Because of how the underlying mechanics of Pendle work, if you withdraw far in time from the underlying strategy maturity date, you may get a bad price for your assets.

What is Yearn X?

"Yearn X" is a user interface that puts partner products front and center. Instead of searching through the normal vault lists for a particular protocol vault, you can go to the UI for that partner. For example, if you are looking for an Aerodrome vault, you can see them all at https://aerodrome.yearn.space/.

The current partner sites are:

How do Harvests Work?

Yearn vaults auto-compound rewards, but they only do so when it makes sense. This means that for some pools, at some times, there is a period where rewards sit in the contract waiting to be harvested or swapped for more of the underlying vault tokens. Understanding how this works is important if you are depositing into some of the smaller pools that are harvested less frequently.

All yearn vaults have a permissionless harvest function that claims rewards earned by the vault. But this only claims the rewards. In order for these rewards to be re-invested, they have to be sold for the underlying vault assets. This is a separate, permissioned step due to the complexity of swapping into some of the more bespoke yVault assets. These swaps occur once there is enough assets waiting to be swapped that the cost to swap isn't too high. This depends on gas costs mainly. Once the assets have been swapped, they are ready to go back into the vault, but are not added until the next harvest call.

The intent is for this process to be happening continuously, where rewards are claimed, swapped, and then when the next round are claimed, the swapped assets get re-invested. For smaller TVL pools or those with low reward rates, this cadence may be delayed. If you are in a vault where rewards have not been claimed in a while, come into the Discord, open a ticket, and let us know!

The easiest way to see if there are harvests is to check if the Price Per Share of a vault is increasing. You can do this using the vault analytics site PowerGlove and clicking on the PPS chart to see if it is growing. Check out this page for a good example of a vault that has an intermittent re-investing period.

How do I use a block explorer to interact with Yearn contracts?

Using a block explorer is advanced and if you have not used one before, we only recommend it to withdraw from a vault that you cannot access from the yearn.fi website, or in an emergency. Yearn, and its website, are in active developement, so issues with the website should be fixed quickly upon reporting them. For many issues it is better to wait for a website fix.

If you need help, come by the discord and open a support ticket.

All of the smart contracts that you will interact with from Yearn's website live on Ethereum or one of its layer-2 networks. We have worked to make the experience of interacting with the contracts as easy as possible via the website, but sometimes something goes wrong and the website may not work. If that happens, you can interact with the underlying contracts directly with a block explorer like Etherscan.

Each network has its block explorer, and many have more than one. The most popular is Etherscan and most networks have a version of it for their users to use.

| Network Name | Etherscan URL |

|---|---|

| Ethereum Mainnet | https://etherscan.io/ |

| Polygon | https://polygonscan.com |

| Optimism | https://optimistic.etherscan.io |

| Base | https://basescan.org |

| Arbitrum | https://arbiscan.io/ |

| GnosisChain | https://gnosisscan.io/ |

| Fantom | https://ftmscan.com |

All of these sites should look and feel and work the same way.

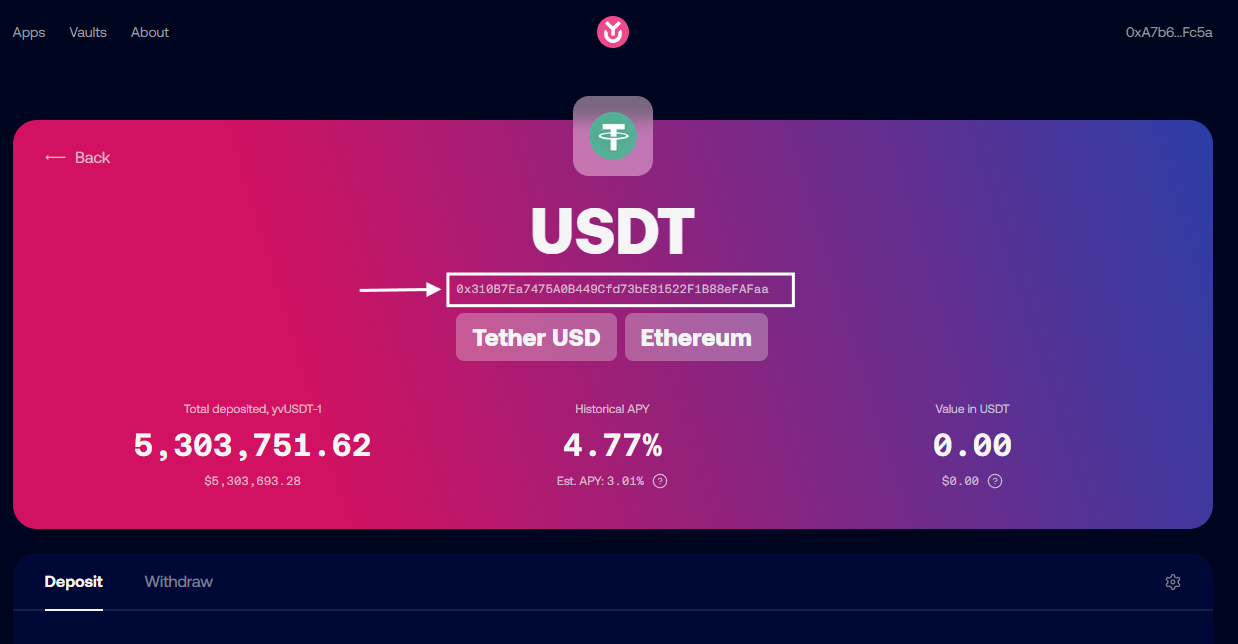

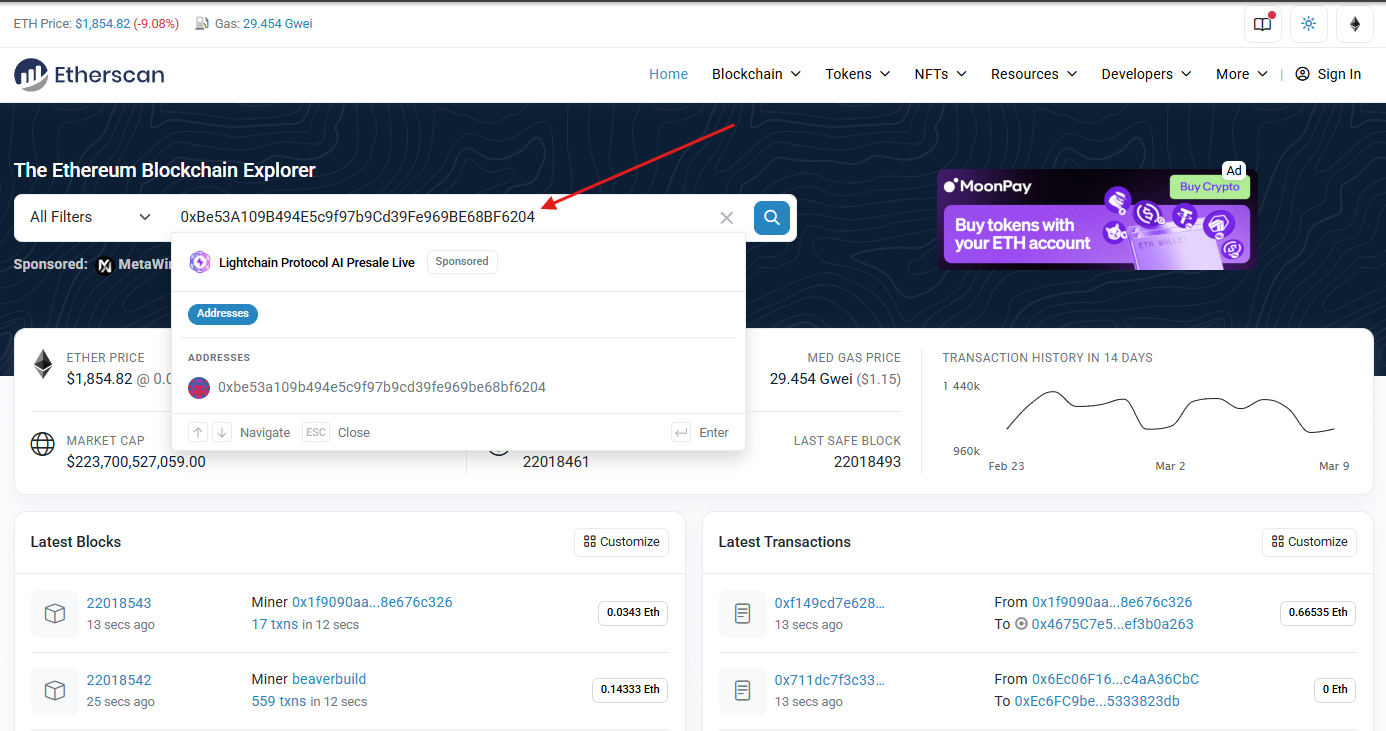

Finding the right Smart Contract

You can find the address of the smart contract that you want to interact with on the Yearn website. It is a 42-digit alphanumeric string. If you navigate to a vault page, the address is listed directly below the name. Click on the address to copy it to the clipboard.

You should confirm that your vault tokens are not staked. On the yearn website, make sure that they show up when trying to withdraw. If not they could be staked in a rewards contract. You can also withdraw from staking contracts on etherscan, but that is outside the scope of this article. So if this applies to you, come to the discord and open a ticket and someone will be able to walk you through the process.

Once you have it copied, go to etherscan.io (or its equivalent for other chains) and paste it into the search bar. Then hit enter and it will bring up a page with information about the contract.

Interacting with the Contract

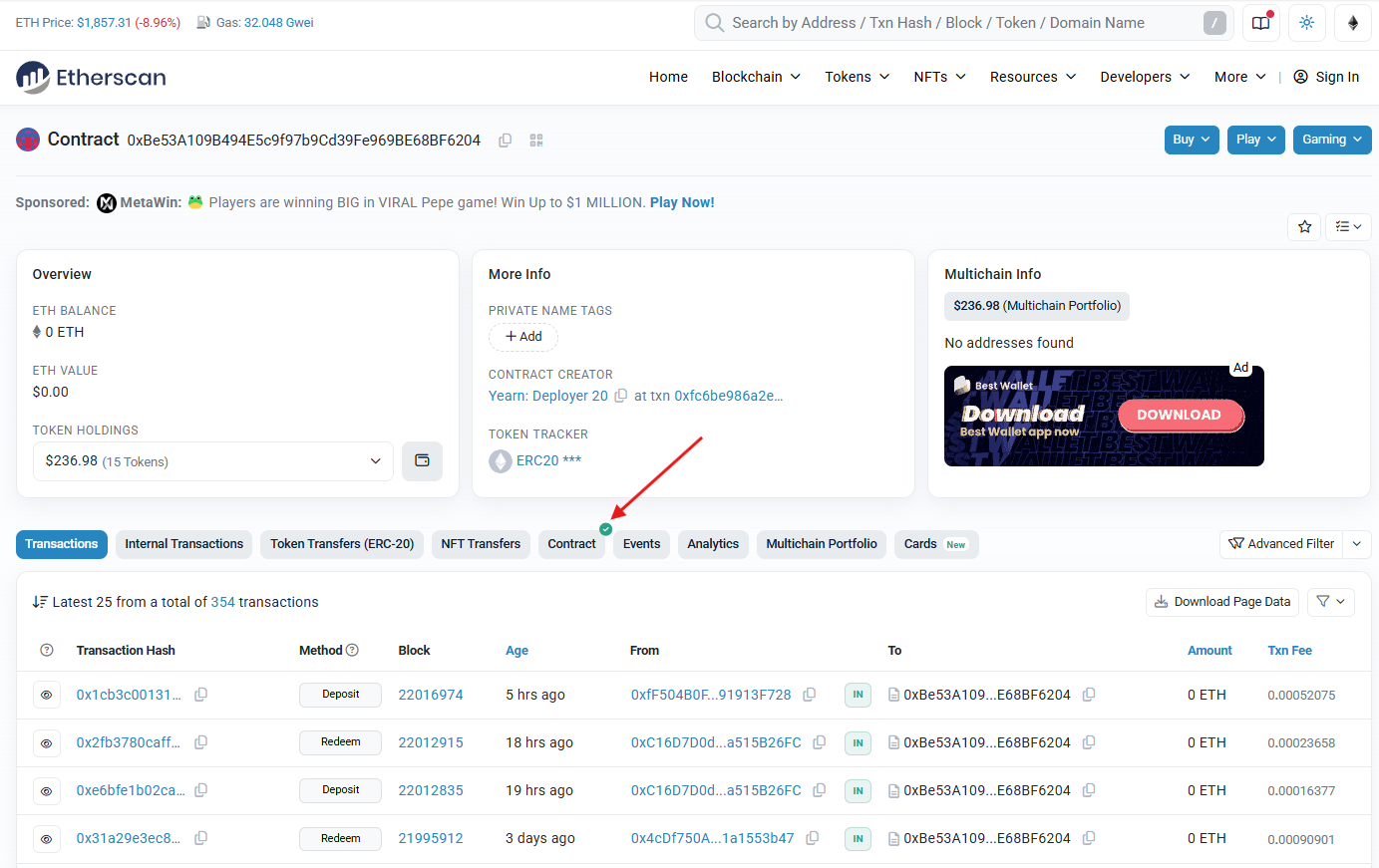

On the landing page, you can see recent transactions that have interacted with the contract.

To interact with the contract, you will need to click on the Contract button.

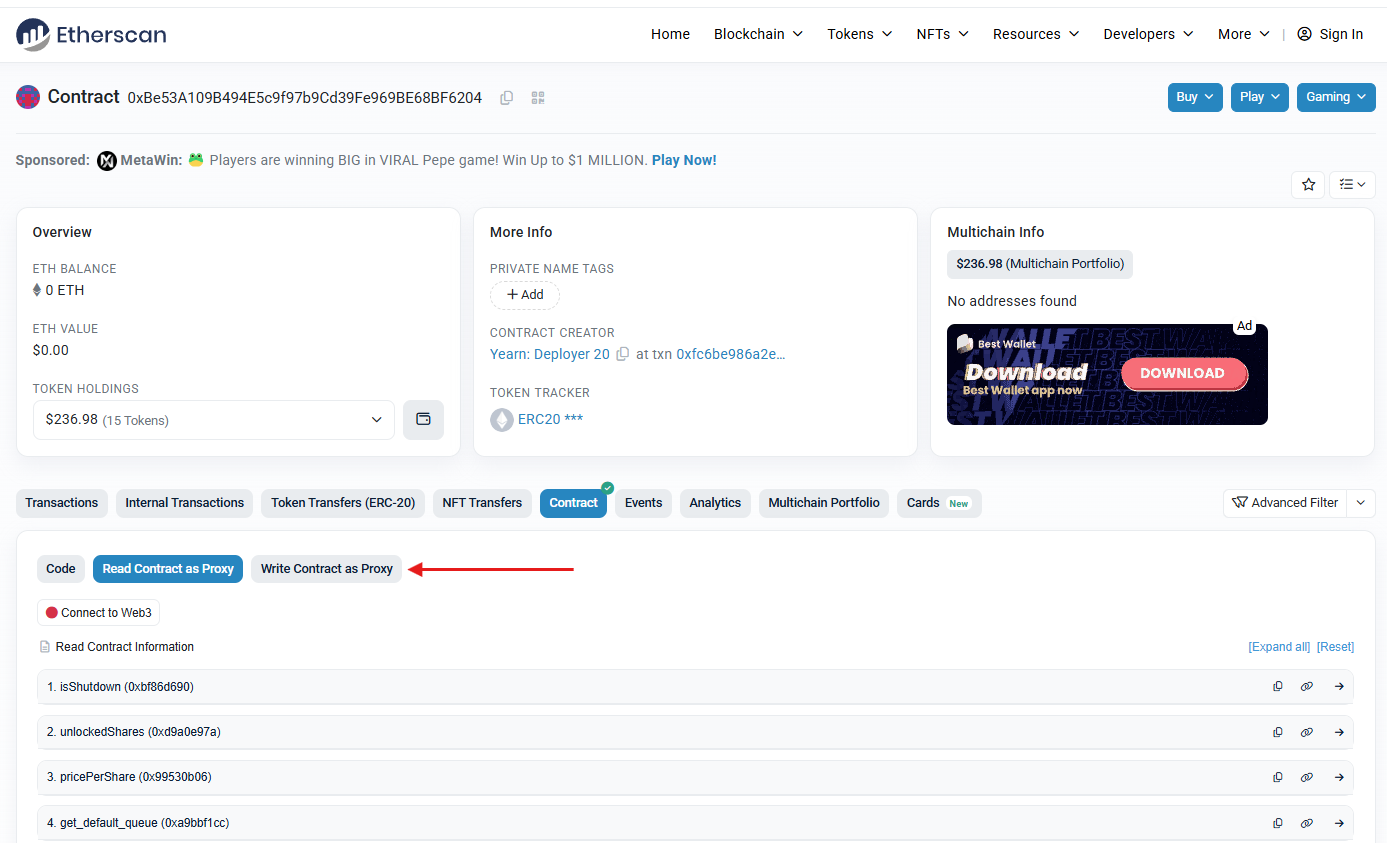

Once you click on the Contract button you will see 3 new tabs: Code, Read Contract (as Proxy), and Write Contract (as Proxy).

- The

Codetab will show you the source code for the smart contract - The

Readtab allows you to query values on the contract like the contract name, user balances, etc. - The

Writetab allows you to perform transactions using the contract, like depositing and withdrawing.

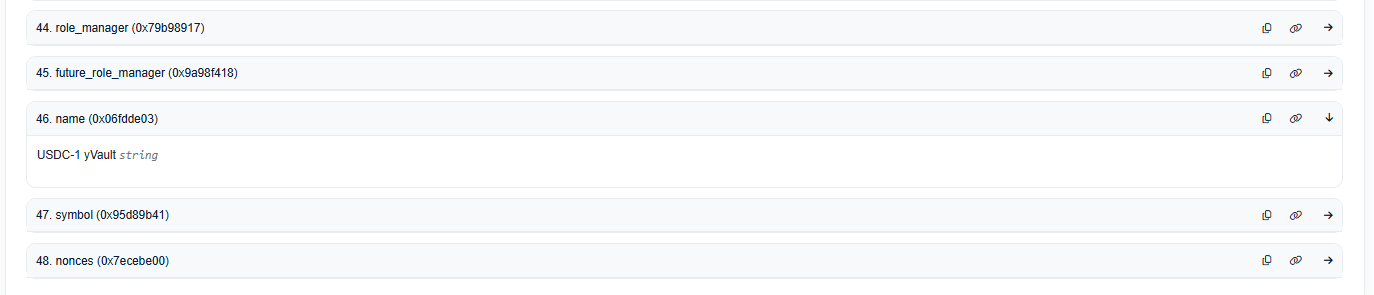

To confirm you are looking at the correct contract, click the Read tab and find the name function in the list and click on it. It should show the vault name (i.e. yvUSDC-1 yVault)

Withdrawing from a vault using Etherscan

-

Click on the

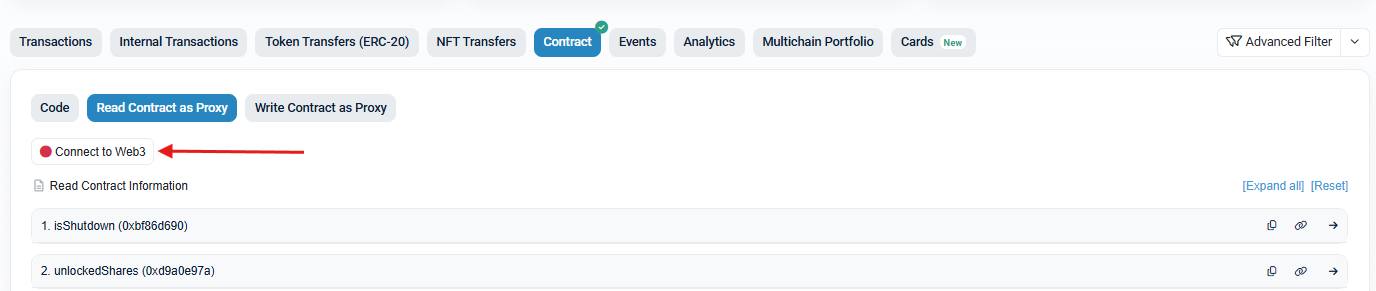

Read Contract as Proxybutton. -

Click on the 🔴

Connect to Web3button and connect the wallet you used to deposit.

-

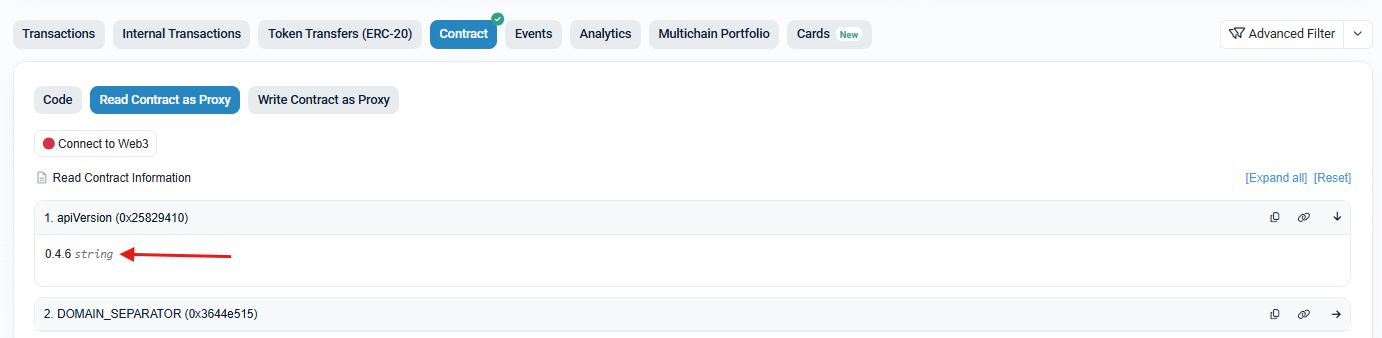

There are different steps depending on what version vault you are using, so lets check the version.

- Find the apiVersion field and click on it.

- If the number starts with 0 (i.e. 0.4.6) then it is a V2 vault.

- If the number starts with 3 (i.e. 3.0.4) then it is a V3 vault.

Once you know the vault type, go on to the next step.

If a V2 Vault:

- Click on

Write Contract as Proxy - Find the first

withdrawfunction. This one should only have a button that says "Write" with no additional fields. - Click

Writeand submit the transaction in your wallet.

Once the transaction is approved you will be fully withdrawn from the Vault.

If a V3 Vault:

- Withdrawing from V3 vaults requires 3 arguments to withdraw: The amount, the owner, and the recipient.

- Both the owner and the recipient will be your wallet address.

- To get the amount, you need get your total balance by clicking on

balanceOfand then entering your wallet address in the address field. Click query and you should get a long number that is your balance. Copy this balance to use in later steps. - Click on

Write Contract as Proxy - find the first

redeemfunction. It will have 3 fields for arguments. Enter the copiedbalanceOfvalue into thesharesfield, and your wallet address into both thereceiverandownerfields. - Click

Writeand submit the transaction in your wallet.

Once the transaction is approved you will be fully withdrawn from the Vault.

I have rSWELL tokens in a Yearn Vault but don't see them anywhere

If you are looking at a wallet or portfolio tracker like Debank, Zerion, or Zapper and it shows you have Swell tokens in a V3 yearn Vault, you need to go to the Swell website to withdraw them: https://app.swellnetwork.io/stake/rswell

The rSWELL vault was built on Yearn V3 contracts but was not deployed by yearn, so we don't show it on our website, but they will!

I see I have a DSProxy but don't know what that is

A DSProxy is a "smart account" similar to a gnosis safe that was used by projects like DefiSaver, instaDapp, Balancer, and others. You most likely have a wallet that controls it.

You may be able to access and operate your DSProxy using the defisaver website.